We know (and have previously blogged about the fact) that the IRS will not call, text, or email a Taxpayer to notify them of a tax problem – Taxpayers will generally always receive a letter first. However, what happens when even purported IRS letters cannot be trusted? At Bryson Law Firm, LLC, we are finding that more and more of our clients are receiving spam and scam mail that to the untrained eye, looks like official and authentic IRS mail. As a result, we wanted to blog today about how Taxpayers can be on alert for this type of correspondence.

When the IRS files a Notice of Federal Tax Lien in the County/Parish Clerk of Court’s Office, it becomes public record. This is done to alert creditors that the US Government has a legal right to the Taxpayer’s property. Scammers and spammers often use these public record filings to try and trick Taxpayers into contacting them under the premise that they are an official arm of the taxing authority to pay money or provide personal information that can be used for identity theft. Even without a Notice of Federal Tax Lien filing, spam and scam IRS mail is possible. Taxpayers have to be very cautious before responding to any correspondence that appears to be from the IRS.

The first step is to authenticate the correspondence. The IRS will send correspondence via USPS. The letter will typically always contain the IRS logo, a notice number/letter number in the top right, your rights as a Taxpayer, your ID number or Social Security number, and the tax years at issue. The telephone number that the IRS provides will typically always be a 1-800 number. IRS letters will usually always be sent to discuss balances due, ask a question about a tax return filing, be sent to verify Taxpayer identity, request additional information, notify the Taxpayer of changes made to a tax return, etc. When a payment is due, IRS letters will instruct you to remit your payment to the US Treasury or via IRS.gov. You should be able to reconcile the notice or letter number via the IRS.gov website. If you still aren’t sure that the letter is authentic, you or your Tax Professional should be able to check your IRS accounts online or with the IRS via telephone to determine whether a notice has been sent.

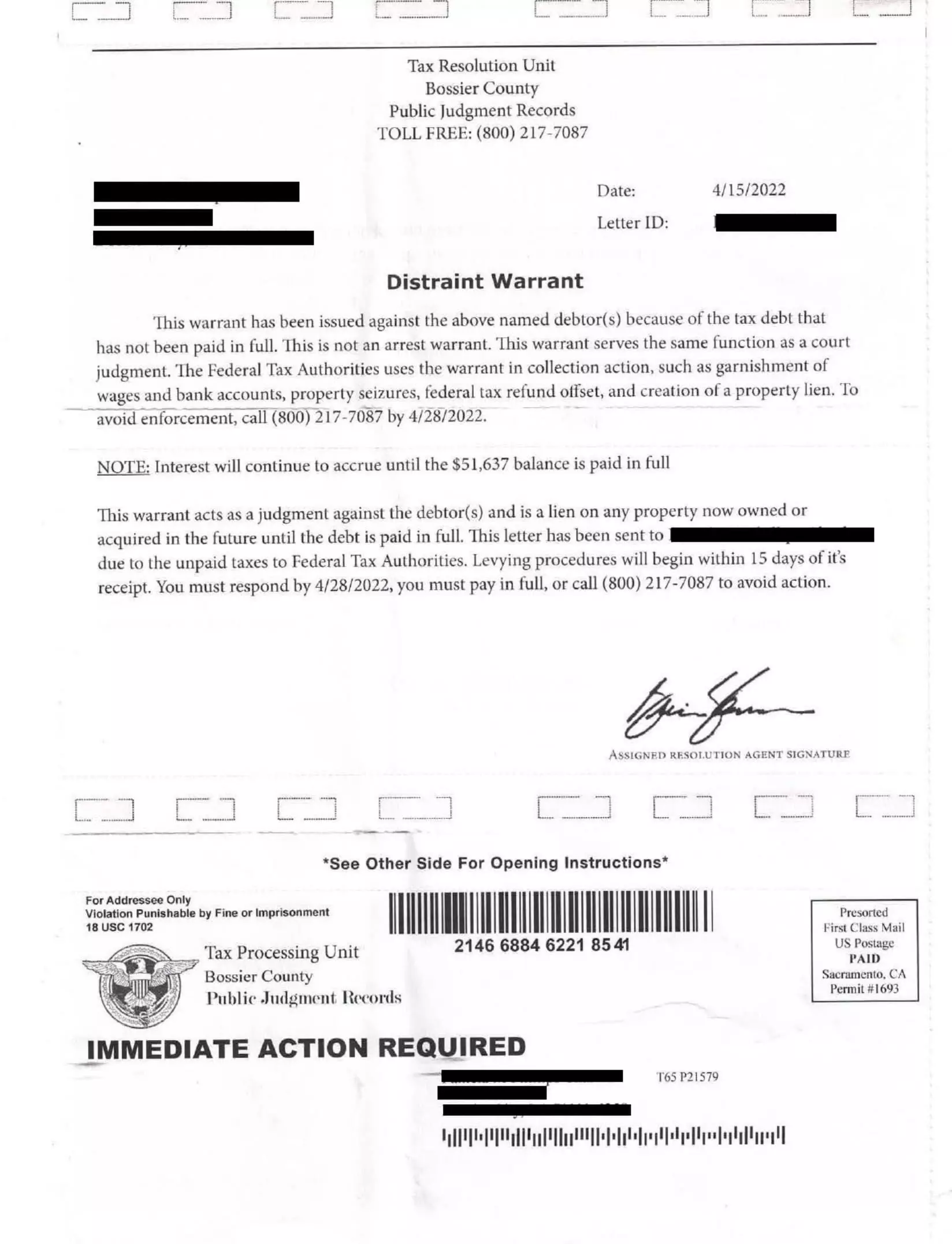

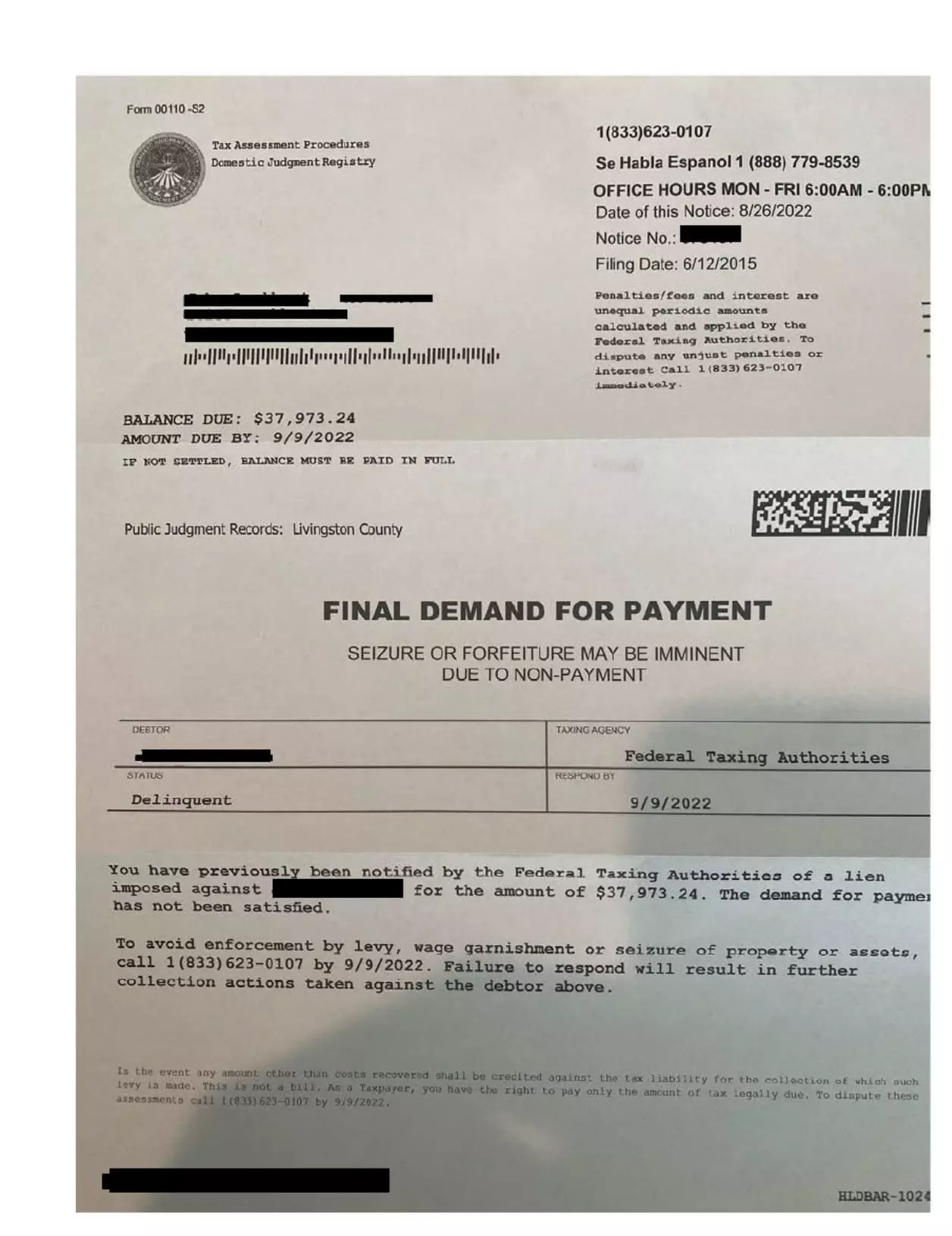

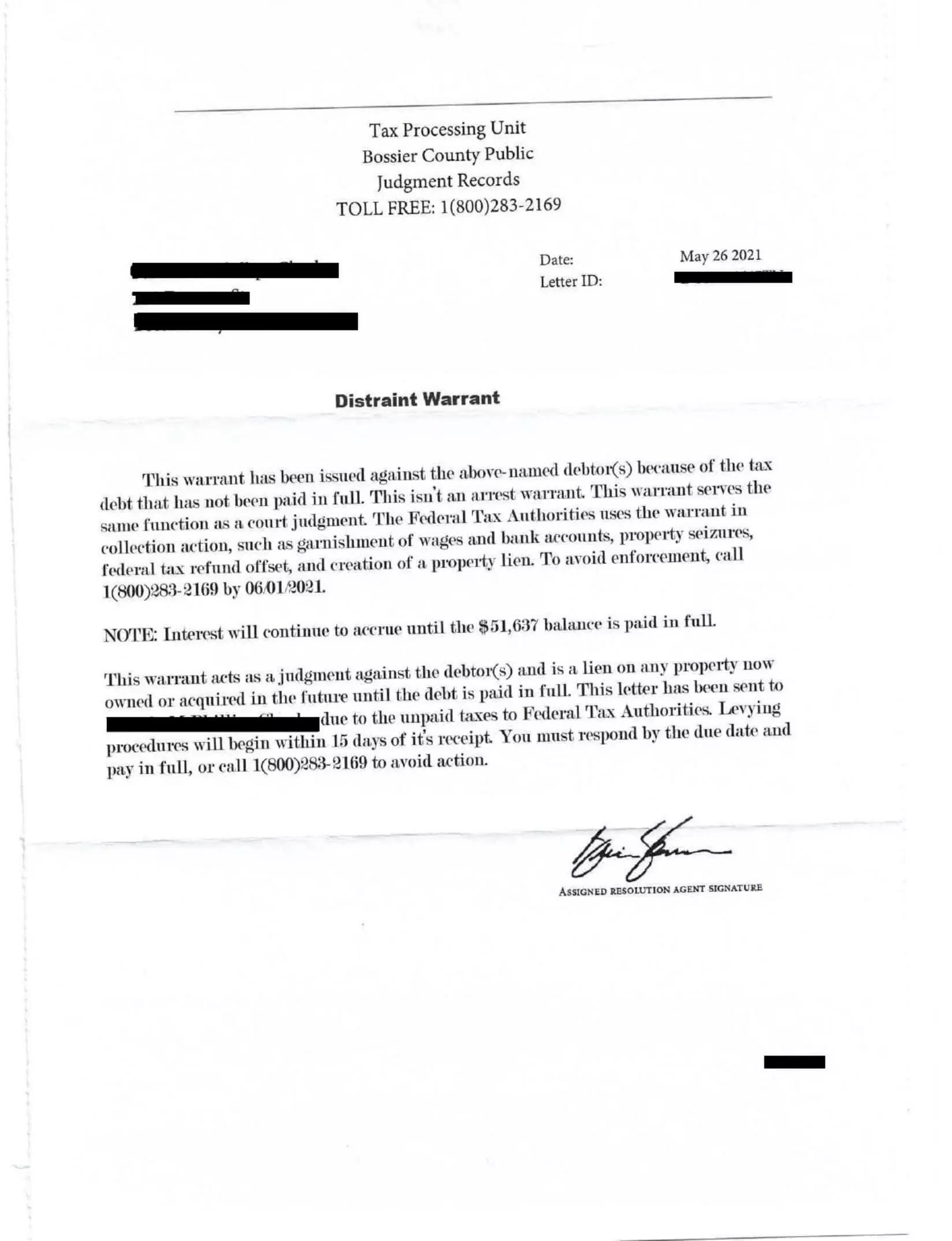

There are several good indicators that can be used to determine a letter is not official IRS correspondence. If the letter does not have the IRS logo, it is likely not from the IRS. Most spam and scam mail will use an agency name such as “Bureau of Tax Enforcement”, “Tax Assessment Procedures Domestic Judgment Registry”, “Federal Taxing Authorities”, etc., which do not exist. Additionally, if the letter includes a demand for immediate payment to someone other than the US Treasury or through official IRS channels like IRS.gov, this is likely not the IRS. The IRS is never going to demand only one form of payment either – the IRS will always provide payment options. If the letter promises that money be given outside of refunds owed per Taxpayer-filed tax returns, this is unlikely to be from the IRS. Finally, if the letter threatens the Taxpayer with arrest or jailtime for failure to comply with the demands, this is likely not an IRS letter. It is important to again note that once the IRS files a Notice of Federal Tax Lien, it becomes public record. That means that even spam or scam correspondence could list the actual tax years and amounts owed and your name and address – all of that is on the public filing. Again, you and/or your Tax Professional should carefully confirm before disregarding.

The IRS asks Taxpayers to report fake IRS notices from spammers and scammers. These should be reported to the Treasury Inspector General for Tax Administration (TIGDA) – they have an IRS Impersonation Scam Reporting page here: https://www.treasury.gov/tigta/reportcrime_misconduct.shtml or to the IRS directly using the This email address is being protected from spambots. You need JavaScript enabled to view it. email address.