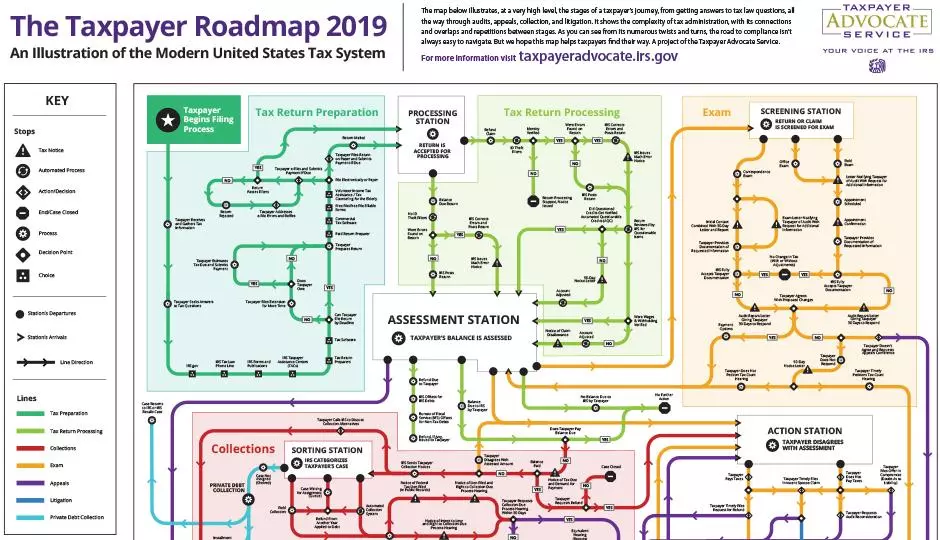

The IRS Taxpayer Advocate Service recently released the attached “Taxpayer Roadmap 2019.” The Roadmap illustrates the stages of a taxpayer’s journey through the IRS system. It is divided into seven stages from return preparation to litigation – and everything in between. One glance at the map shows that the system is highly complex . . . but as taxpayers we already knew that, right?!

In a news release on July 10, 2019 (IR-2019-123), the IRS itself observed, “The map makes clear the complexity of tax administration, with its many connections, overlaps, and repetitions between stages. Notably, it shows why the road to tax compliance isn’t always easy to navigate.”

Continuing, the IRS stated, “Because of the complexity and number of steps at each stage, the original roadmaps simplified certain processes by omitting multiple sub-steps and detours that in some situations can be significant.”

After studying the Roadmap, we agree that it accurately depicts the tax process (albeit complicated) as it is intended to flow. But, like any other map, the IRS Roadmap is a static flat document, and it cannot and does not illustrate or account for the traffic jams . . . potholes . . . driver error . . . or other pitfalls along the way. In a system this intricate things are bound to go wrong and get tangled!

And, that’s our specialty! We are experts in guiding tax troubled clients back onto the main tax roadways. We have literally helped thousands of families and their businesses fix their tax problems. We anticipate the tax road blocks and tax detours and tax flat tires that taxpayers can experience.

Take a minute to look over the Roadmap. The green “tax preparation and tax return processing” areas of the Roadmap are the simple, easy roadways. They don’t look too daunting. You file your tax return, the return is processed, the tax bill is assessed and is paid. But, if something gets out of whack you can end up in the yellow “screening station” for audits, or even worse the red “collection station” where you’ll find Tax Liens and Tax Levies and Wage Garnishments and all sorts of other scary collection enforcement!

This sounds like a video game, huh? But it’s more like Wreck It Ralph! There’s nothing fun about having your hard-earned money or property taken by the IRS simply because you didn’t know how to follow the Roadmap or because someone along the chain didn’t do something correctly!

Glance at the Map’s “key”. Look at how many “stops” are found on the map! Look at how many “decisions” and “choices” are required by IRS employees! It’s no wonder things go haywire sometimes. One bad day for an IRS worker who sees you simply as a number in the system, and you’ll end up in the red zone.

If you find yourself struggling to navigate the IRS Roadmap (and you’re not alone) you should consider getting help. Having an experienced team of tax professionals on your side is like having personal tour guides leading you through the IRS jungle – and carrying your luggage on the way! Don’t wander alone! Get some help – call us today!